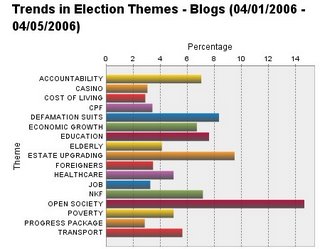

Accountability

Casino

Cost of Living

CPF

Defamation Suits

Economic Growth

Elderly

Estate Up Grading

Foreigners

Healthcare

Job

NKF

Open Society

Poverty

Progress Package

Transport

I have tried to cover the list as much as possible without hyperlinking to the same posts. But many of the current election themes do over lap - a lot. One political party was in power at the time of all the above archived post, so yes if it was an article posted in 2004 it is still very relevant as talk is cheap and talk by a politician during an election is dirt cheap.

The image is originally from NexLabs.

2 comments:

Saw this interesting comment about HDB pricing:

http://groups.yahoo.com/group/Sg_Review/message/2382

Date: 2 May 2006

To: Editor, Singapore Review

From: Mr See Leong Kit ( 58-year old Citizen-Voter )

Subject: How HDB Flats are priced --- a larger Election Issue than

the childish Gomez hoo-haa

1 Important Note for fellow S'poreans:

>> In the event our shamelessly pro-PAP (instead of pro-Singapore) Media will not publish or censor my contributed letter below, please help to circulate freely/widely (way before this Saturday's Polling Day) to all interested parties.

>> Insightful Quotation:

"Singapore is a supposedly First-World Country with a supposedly Open Government, run by supposedly World-Class million-dollar ministers and supposedly First-Class half-a-million dollar senior civil servants."

2 Original Text of my letter sent to TODAY newspaper:

I refer to your report "Mah to SDA: Want to build flats for me?" (May 2).

It has been rightly described that our private home prices are "obscene" while HDB flat prices are "sky-high". Indeed, the exorbitant cost for something as basic as a roof over our heads is a major factor behind our high cost of living.

Some 90% of Singaporeans (ranging from managers to low-salaried workers) are thus resigned to living in HDB flats. Hence, they have every right to know whether HDB flats are priced with a true cash subsidy or a cleverly-disguised profit.

Over the past five years, various writers in newspaper forums have rightly questioned why a new HDB 5-rm flat is priced upwards of $200,000 when its construction cost is around $50,000 (as revealed from actual HDB construction contracts).

As HDB flats are now built higher and closer together i.e. many units occupying a tiny plot of land, it is a lame argument for the HDB to say that the hugh difference of $150,000 is accounted for by land cost and other related costs.

The HDB's standard dodgy reply has been that a so-called "market subsidy" is provided for new HDB flats to make them "affordable" i.e. they are priced below their equivalent market value.

This is how the "market subsidy" pricing approach works. The HDB will first look at the prevailing market value of a 5-rm resale flat (say, $260,000) and then "pluck from the air" a slightly lower figure (say,$200,000) as the selling price of the 5-rm new flat --- never mind even if its total breakeven cost is probably around $120,000!

The HDB can then boast that the new flat buyer is getting a $60,000 "market subsidy" --- when there is actually no "true cash subsidy" at all.

Instead, from the example given, the HDB is raking in a handsome profit of $80,000 for each new flat sold.

Indeed, this ingenious "market subsidy" approach had resulted in new flat prices and resale flat prices chasing each other in an upward spiral --- to the detriment of all buyers of both new and resale flats.

During this election, our educated thinking voters were not amused (much less impressed) by the never-ending nagging and nitpicking over an administrative form-filling issue.

Compared to this childish hullabaloo, how HDB flats are priced is certainly a larger national issue related to First-World transparent governance.

Mr Mah Bow Tan should thus seize this golden opportunity to demonstrate to our citizen-voters his ministerial mettle and justify his handsome remuneration in providing simple honest answers to these pertinent questions:

> Since HDB flats are supposed to be low-cost mass public housing, why is the HDB not helping our citizens in home ownership by passing on to them the cost-savings from economies of scale in massive HDB developments through pricing new flats on a cost-recovery breakeven no-profit basis?

> Are HDB new flats priced with a "true cash subsidy"?

If the answer is No, say so directly and openly.

If the answer is Yes, convince the people with detailed numbers and indicate the amount of the true cash subsidy.

hm, that's precisely what I'm concern as Singaporeans at the middle-income level are facing with liabilities until the age of about 40 years old.

The use of CPF to repay the loan seems to divert our attention on the profit issue as it doesn't concern any visible cash outflows.

I've recently calculated the revenues of a single HDB flat. To be conservative, I shall assume each unit averagely cost 200k and to be conservative again, there's roughly 100 units per HDB flat. It sums up to a sales revenue of 20 million per flat. And I wondered how much the govt. received in residual of the construction costs.

And probably, they might wanna reveal where those profits went? I think accountability is the word and justifiablity as to why there's a need for such a huge profit margin (if there is).

Post a Comment